[ad_1]

Studying learn to become worthwhile when you sleep is, fairly frankly, the ultimate phrase operate of monetary independence. In any case, incomes passive revenue might be going certainly one of many largest methods to flee the grasp of your 9-to-5 job.

Warren Buffet is legendary for making this very important stage about establishing wealth:

“Whilst you don’t uncover a way to become worthwhile when you sleep, you’ll work till you die.”

– Warren Buffett

Nonetheless how do you become worthwhile when you sleep? And what are the proper methods to assemble passive revenue streams to switch the revenue out of your widespread job?

It boils correct proper right down to your particular explicit particular person talents, targets, and whether or not or not or not you may have gotten any money to take a spot upfront.

17 Methods to Earn Cash Whereas You Sleep

In case you need to become worthwhile when you sleep, there are an quite a few variety of methods to go about it. Listed beneath are 17 extreme methods you may try in the meanwhile.

#1: Put money into Short-term-Time interval Financial monetary financial savings

A high-yield financial monetary financial savings account gained’t web moderately loads passive revenue, nonetheless it would presumably permit you safe an honest financial monetary financial savings return. It’s furthermore a extremely good place to retailer your emergency fund. Financial monetary financial savings accounts protect your money liquid and readily accessible, so you are going to get your palms in your cash if wished.

Cash in a on daily basis financial monetary financial savings account could possibly be FDIC-insured, so that you just simply gained’t lose your belongings. You’re protected as loads as $250,000 per depositor, per establishment) in case your financial institution defaults or goes out of enterprise.

The Fed has been elevating fees of curiosity due to inflation, which suggests greater returns than in earlier years. Questioning which on-line financial monetary financial savings accounts present the proper return in your cash with little to no costs?

In the meanwhile, I desire to counsel Uncover, Citi Velocity up Financial monetary financial savings, and SoFi Cash.

Cash market accounts may permit you earn passive revenue, they usually additionally don’t tie up your money. They’re like a combination between financial monetary financial savings accounts and CDs, nonetheless they don’t tie up your money one of the best ways by which CDs do. You often earn a better yield, you may entry your money anytime with out penalty, they often’re FDIC-insured.

Cash market accounts with the proper yields come from largely on-line banks. These embrace alternatives like Uncover, Ponce Financial institution, and Quontic Financial institution.

With UFB Direct, as an illustration, you may earn 3.01% APY on financial monetary financial savings with no annual, account upkeep, or hidden costs. Chances are high you will even get a bonus of as loads as $300 everytime you open a mannequin new account with direct deposit.

- * No minimal deposit required

- * No upkeep costs

- * 24/7 entry to your funds

- * FDIC insured

#2: Put money into Digital Exact Property

Exact Property Funding Trusts (REITS) are pooled investments that use bodily exact property as an underlying asset, nonetheless there are utterly completely different methods to position money into digital exact property.

Positive, you should buy a plot of land contained in the metaverse, nonetheless I’m not speaking about that.

After I discuss of investing in digital exact property, I’m actually speaking about digital belongings:

- Authority web sites that take into account a specific area of curiosity

- eCommerce retailers that promote bodily merchandise

- Digital merchandise like eBooks and packages

- Domains you should buy and promote on web sites like Flippa

- E-mail lists you may assemble and promote to others

- Subscription web pages that require month-to-month or annual costs

- Cellular apps

- YouTube channels which could possibly be finally monetized

- Social media channels which could possibly be monetized over time

My favourite digital asset is the net web page you’re discovering out – GoodFinancialCents.com. I began this net web page over a decade so far, and since then, I’ve used it to earn an entire bunch of 1000’s of {{{dollars}}}.

It wasn’t straightforward – I earned virtually nothing for the primary 12 months I spent working a weblog whereas juggling a full-time job. Nonetheless, I lastly turned this net web page into the money-making machine it’s in the meanwhile.

Whilst you’re occupied with learn to begin an online web page you may monetize, be sure to strive the following weblog publish:

Furthermore, keep in mind signing up for my Make 1k Working a weblog course, which is 100% free. It’s designed which will allow you to get your weblog set up so you may earn your first $1,000 on-line.

Chances are high you will be part of utilizing your e-mail cope with and be in your method to getting cash working a weblog in a short while.

#3: Affiliate Selling

Whilst you resolve to start out your explicit particular person weblog, you’ll need to strive net on-line affiliate web advertising and marketing.

Nonetheless what’s net on-line affiliate web advertising and marketing? Principally, it’s a manner that helps you earn cash when any particular person clicks on affiliate hyperlinks you promote.

Let’s say you write a weblog publish concerning the good journey backpacks, and likewise you fill it with hyperlinks that earn you a value when any particular person makes a purchase order order order. That, my buddies, is net on-line affiliate web advertising and marketing.

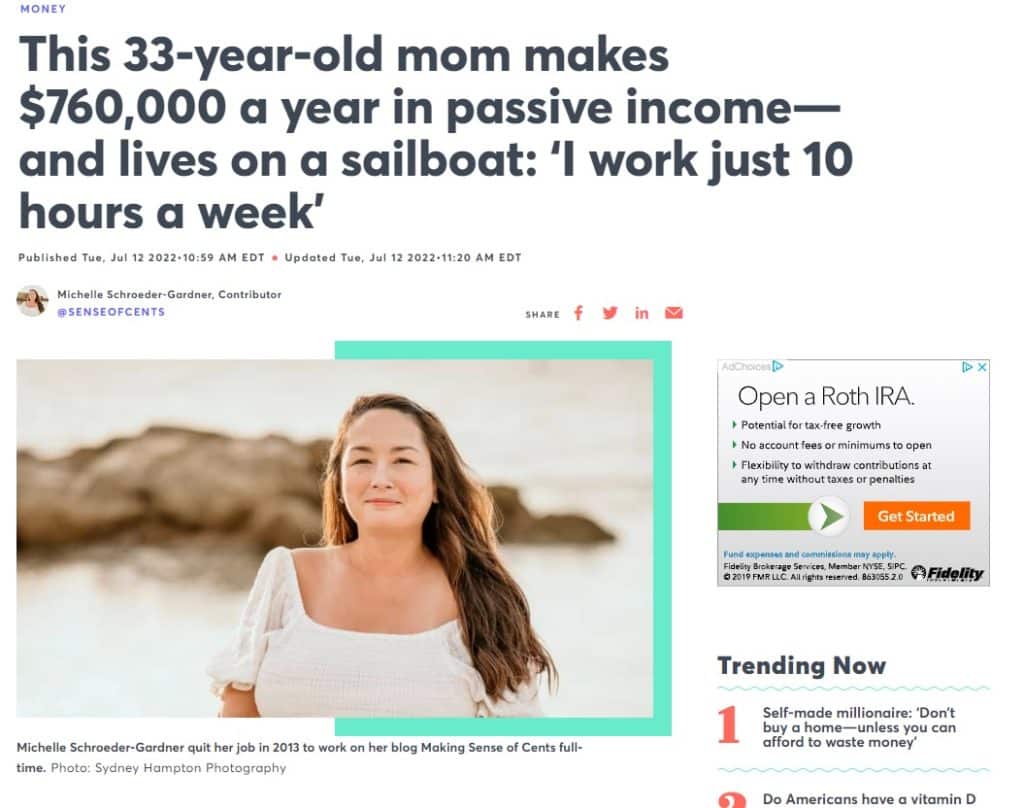

My pal Michelle from Making Sense of Cents is a grasp of net on-line affiliate web advertising and marketing who has earned an entire bunch of 1000’s of {{{dollars}}} alongside alongside together with her net web page over time. She not too manner again had her first teenager, nonetheless she nonetheless earns $760,000 yearly.

The suitable half? She lives on a sailboat year-round, and she or he spends the overwhelming majority of her time crusing all through the Bahamas whereas working merely 10 hours per week.

#4: Purchase a Certificates of Deposit (CD)

A certificates of deposit (CD) earns further money than a financial monetary financial savings account, nonetheless you might want to “lock up” your cash for a tricky and fast interval – usually not decrease than six or 12 months. It is on account of, in distinction to financial monetary financial savings accounts, CDs are bought for a specific time interval.

As rapidly as you start researching alternatives to look out the largest CD costs, you’ll uncover that banks like Capital One present yields appropriately above 3% for his or her longer CDs. You’ll earn loads a lot much less do it’s important to purchase a CD with a shorter timeline, nonetheless you may open on-line CDs with phrases as little as six months and a few fairly respectable costs.

Merely take into account the reality that do it’s important to open a CD, you’ll should decide to conserving your money locked away by means of the CD time interval. If you wish to entry your cash early, you’ll get hit with early withdrawal costs and miss out on varied the curiosity you’ll have earned.

#5: Put money into Sequence I Financial monetary financial savings Bonds

In case you need to safe an distinctive yield on as loads as $10,000 (or $20,000 for a pair) and likewise you’re capable of lock your cash away for not decrease than 12 months, it is best to remember Sequence I Financial monetary financial savings Bonds. These government-backed financial monetary financial savings bonds are presently incomes 9.62%, and people can buy as loads as $10,000 full in these bonds each calendar 12 months.

That’s varied curiosity you may earn in your sleep, nonetheless it is best to know that you just simply merely cannot entry the cash you set money into these bonds till not decrease than 12 months have handed. Chances are high you will entry your cash after that, nonetheless you’ll pay a penalty of three months of curiosity do it’s important to money out your Sequence I Financial monetary financial savings Bonds ahead of 5 years go.

In keeping with the Bureau of the Fiscal Service on the U.S. Division of the Treasury, Sequence I Financial monetary financial savings Bonds present an excellent method to develop your financial monetary financial savings or complement your retirement revenue whereas defending your belongings from inflation. They’re furthermore quite simple to purchase on-line, and you should purchase them for each member of the household.

#6: Put money into Shares

Inventory investing might be going certainly one of many largest methods to earn passive revenue. In actuality, the S&P 500 (one amongst many predominant inventory market indexes) outfitted a indicate return of 8.91% by the use of the 20 years predominant as loads as the start of 2022. Whilst you span out 30 years as an alternative, the widespread return will enhance to 9.89%.

Once you might be proud of that return, it is best to remember investing in index funds. They protect all predominant corporations on the S&P 500, or whichever benchmark your index fund tracks. This protects you from choosing particular explicit particular person shares and presents quick portfolio diversification.

Primarily essentially the most well-liked index funds embrace the Vanguard Full Inventory Market Index Fund Admiral Shares (VTSAX), Vanguard 500 Index Fund Admiral Shares (VFIAX), Constancy ZERO Massive Cap Index (FNILX), and Invesco QQQ Notion ETF (QQQ).

The reality is, additionally it is potential to aim your luck investing particularly explicit particular person shares do it’s important to’re prepared and able to perform just a little evaluation and legwork upfront. You presumably could even flip to a robo-advisor which is able to permit you craft a personalised portfolio.

For example, M1 Finance enables you to purchase funding pies which could possibly be expertly crafted which will allow you to attain your funding targets. Bigger nonetheless, they help you to place money into inventory with no costs required, and you’ll select from a gaggle of current pies or create your explicit particular person.

Additionally it is potential to lean on assist from a robo-advisor like Betterment inside the case of establishing a portfolio of shares which will allow you to become worthwhile when you sleep. Betterment enables you to begin investing with as little as $10, and you’ll income from perks like automated investing and tax loss harvesting.

- * Account Minimal $100

- * Assemble customized portfolios (or)

- * Select knowledgeable portfolios

- * Shares, ETFs, REITs

#7: Put money into Exact Property Funding Trusts (REITs)

Exact Property Funding Trusts (REITs) are but yet another automotive that means that you can earn passive revenue when you sleep. REITs work equally to shares by which you can even make investments a lump sum upfront or widespread contributions over time. Nonetheless, your cash is used to position money into income-producing exact property as an alternative of assorted asset packages.

Lastly, this implies REITs help you to place money into exact property with out the hassles and stress of being a landlord. REITs furthermore require moderately loads loads a lot much less upfront capital than you’ll need should you will have been looking for bodily property.

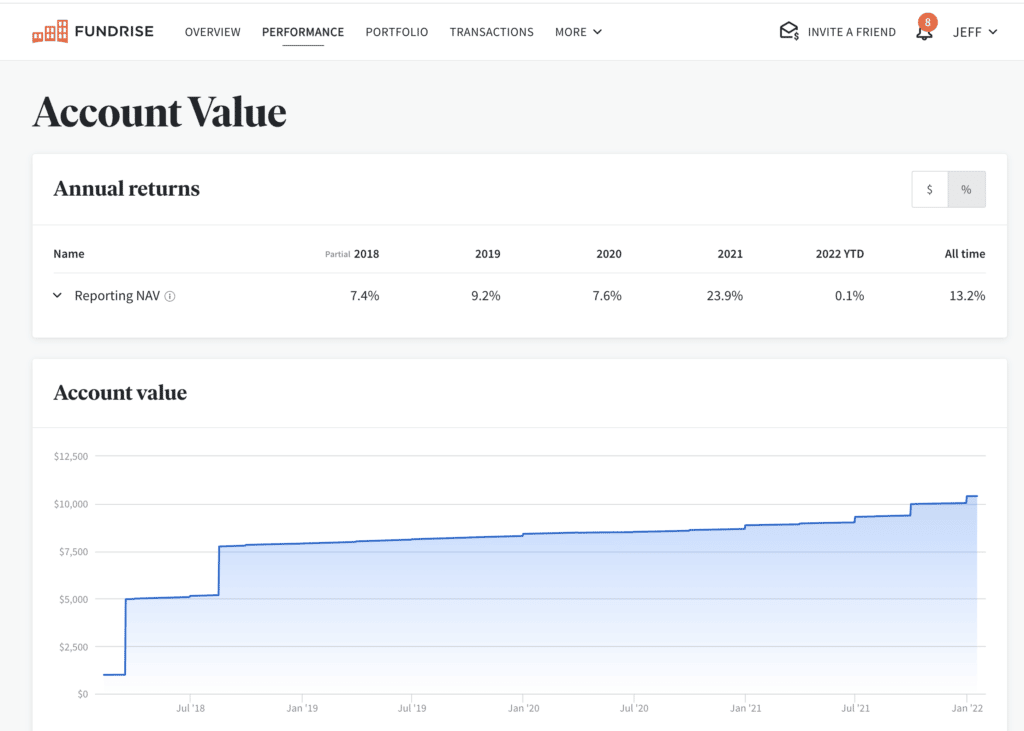

My favourite method to position money into exact property passively depends upon an app usually generally known as Fundrise. With Fundrise, you may start investing in exact property with as little as $10, and you’ll set up automated investments, so your exact property portfolio grows seamlessly over time.

Beneath yow will uncover a present show of my very private account, which reveals my returns over the last few years.

In keeping with Fundrise, their patrons cherished widespread returns of seven.31% in 2020, adopted by a return of twenty-two.99% in 2021. So far, in 2022, patrons have cherished a indicate return of 5.52%.

- * Put money into exact property with $10

- * Open to all patrons

- * On-line straightforward to make the most of net web page and app

#8: Change proper right into a Landlord

Whereas I can advocate REITs, bodily exact property presents moderately extra potential. There’s additional hands-on work concerned, nonetheless bodily properties help you to earn rental revenue whereas your tenants cowl the mortgage funds.

Additionally it is potential to income from exact property appreciation, a extreme boon for landlords over the last few years. A latest report from the Nationwide Affiliation of Realtors (NAR) confirmed that the median product gross sales price for current houses rose 13.4% by the use of the one-year interval predominant as loads as July 2022. Amazingly, that’s after a number of years of fantastic exact property returns nationally.

The draw once more of investing in bodily exact property is the 20% downpayment that’s required. That’s $60,000 on an funding property price $300,000. In a number of phrases, you need a considerable sum of cash to get began.

Happily, the largest mortgage corporations present an excessive amount of methods to get funding for funding exact property. Chances are high you will even use an FHA mortgage do it’s important to’re within the hunt for a multi-unit property (as loads as 4 devices) and you plan to stay there.

Rental properties help you to earn revenue whereas your tenants cowl the mortgage funds.

#9: Dive Into Fully completely different Investments

Additionally it is potential to remember quite a few investments that permit you earn cash when you sleep, together with alternatives like Masterworks and Yieldstreet. These alternatives aren’t mainstream, nonetheless they will allow you to earn greater returns than you’ll get with a financial monetary financial savings account whereas diversifying your portfolio into quite a few asset packages.

Masterworks

For example, Masterworks enables you to put money into particular explicit particular person devices of work. In doing so, you may income as the worth of that work will enhance over time, whether or not or not or not you purchase just a little little bit of a multi-million buck portray or one issue actually distinctive from an up-and-coming artist.

In keeping with Masterworks, your returns will in all probability be distinctive, too. They declare that stylish work has elevated in worth at a price of 13.8% per 12 months over the earlier 25 years. Be taught additional in our Masterworks take into account.

Yieldstreet

Contained in the meantime, Yieldstreet enables you to put money into non-public markets unfold all by means of quite a few investments in industrial exact property, marine duties, and even work. Additionally it is potential to position money into short-term notes.

The minimal funding with Yieldstreet begins at $500, and you’ll select the sorts of investments or the funds you set your cash in.

Vint

One different different is Vint, which helps you to put money into terribly priceless top of the range wines. Wonderful wine tends to know in worth over time, much like work, and Vint enables you to get just a little little bit of the pie.

The creators of Vint declare the worth of high quality wines has gone up higher than 50% over the earlier 5 years and higher than 25% over the earlier 12 months. You don’t should enter your monetary establishment card or banking data to take a spot, and Vint will permit you craft a worthwhile portfolio that is smart in your long-term targets.

Fully completely different quite a few investments embrace multi-family REITs by way of a platform usually generally known as DiversyFund and crowdsourced industrial exact property for accredited patrons with EquityMultiple. Each platforms help you to make investments as little as $500 with exact property on account of the underlying asset, which makes them much like how Fundrise works.

#10: Create a Product You Can Promote

Chances are high you will earn passive revenue when you sleep by making a product you may promote repeatedly. This may possible very properly be a bodily product you create in bulk after which promote on an web based market, nonetheless it could be a digital product you create as rapidly as so you may market it on-line all through the clock.

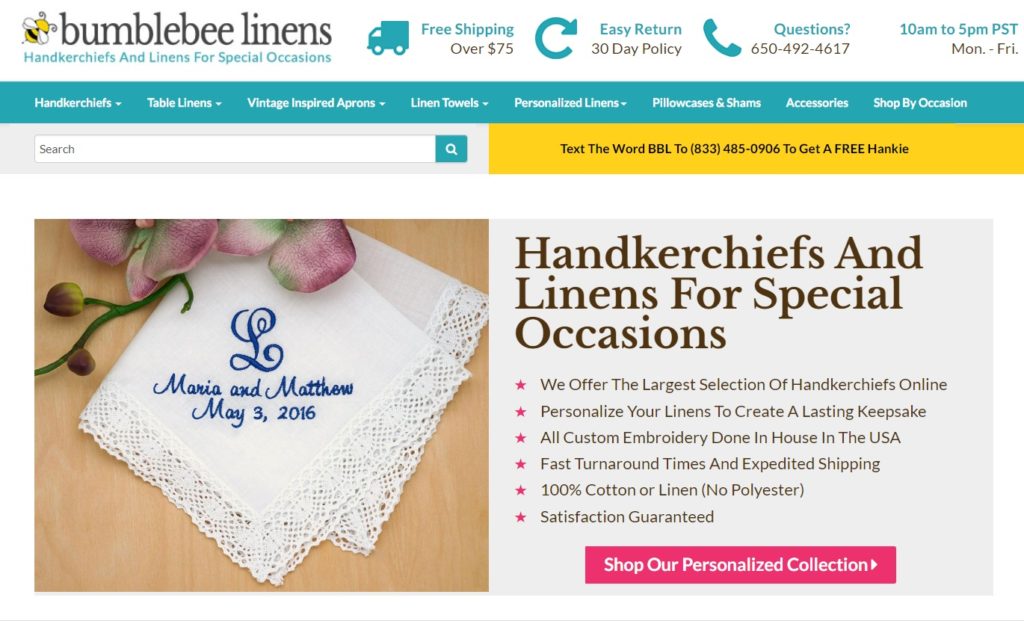

A bodily product will in all probability be one factor. For example, my pal Steve Chou began an web based net web page that sells a specific type of linens which could possibly be considerably highly effective to look out. He has since earned an entire bunch of 1000’s of {{{dollars}}} working Bumblebee Linens, and all from the consolation of his dwelling.

Then there are online-only merchandise, which might be nearly one factor you may dream up!

Examples of digital merchandise you may promote embrace:

- An internet based course

- A pay-per-view webinar

- Printables folks can purchase on-line and print from dwelling

- Instructional merchandise

- Music or work

- Licenses to make the most of digital belongings you non-public

There are such a lot of advantages to making a digital product you may promote. To start out out with, start-up prices will in all probability be low, and your revenue potential is sky-high because you don’t have any supplies to purchase.

Additionally it is potential to automate many processes, and there’s no ceiling on the variety of prospects you may acquire everytime you promote a bodily or digital product on-line.

#11: Write an eBook

One completely different digital product price contemplating is an eBook. Give it some thought or not, you may even make large cash writing and promoting books on completely different on-line platforms.

Your e-book might very properly be about one factor, whether or not or not or not you need to write kids’s tales or create a how-to e-book on a subject you acknowledge loads about.

The suitable half is you may market and promote your eBook on-line, alongside all the favored books from typical authors. In actuality, eBooks are among the many many most fascinating methods folks use to become worthwhile on Amazon.com.

#12: Create an On-line Course

One completely different method to become worthwhile on-line consists of establishing an web based course spherical one issue you acknowledge. Take my very private course – The Passive $1K System™ – as an illustration.

I do know loads about establishing a passive revenue utilizing digital belongings (like my net web page and YouTube channel), so I constructed this course spherical this explicit matter.

With the Passive $1K System™, college faculty college students can analysis all the proper methods to earn passive revenue completely from dwelling and on their very private phrases, whereas I earn passive revenue with every sale I make.

Nonetheless, ample about me. We’re speaking about your passive revenue, right? To assemble a worthwhile on-line course, you merely need to ponder the problems you acknowledge most likely primarily essentially the most about.

Examples of widespread on-line packages embrace ones on:

There are even packages on learn to make packages! Every technique, you may assemble your explicit particular person on-line course utilizing a platform like Teachable and watch the cash roll in from there.

#13: Begin a Membership Website online

Have you ever ever ever ever thought-about beginning a membership net web page or possibly a paid Fb group? This alternative works as a standalone money-making enterprise, nonetheless additionally it is potential to supply a paid group as a companion to an web based course or a digital product.

And no, I’m not speaking about beginning an OnlyFans🤣.

I’m speaking about beginning a membership net web page on a subject you acknowledge loads about, whether or not or not or not it’s investing, flipping exact property, or making do-it-yourself vegan meals.

For example, a journey blogger named Nomadic Matt began his non-public membership net web page as a companion product for his utterly completely different alternatives. With Nomadic Matt Plus, members get right of entry to distinctive content material materials supplies, books, and reductions which is able to assist them journey better for lots a lot much less.

This membership prices folks $5 to $25 per 30 days, which isn’t an infinite funding on the a part of the patron. Nonetheless, consider how moderately loads passive revenue Nomadic Matt is incomes for offering this extra content material materials supplies!

If he has 100 month-to-month subscribers, he earns $500 to $2,500 per 30 days in membership costs.

If he has 200 subscribers, he’s incomes $1,000 to $5,000 per 30 days!

If Nomadic Matt has 1,000 subscribers, he’s incomes a minimal of $5,000 to $25,000 in passive revenue with this earnings stream alone.

#14: Begin a YouTube Channel

Subsequent up, you may try your hand at getting cash on YouTube. Whereas incomes exact revenue with this video platform isn’t as straightforward on account of it appears to be like, you may earn cash when you sleep for those who occur to’re able to take a spot a while and work upfront.

I ought to know. I began my Wealth Hacker YouTube web net web page varied years so far, and it’s grow to be thought-about one amongst my most dependable revenue streams. I saved grinding away even when it felt like I wasn’t getting anyplace. With a big quantity of sweat fairness put in over time, I now have nearly 400,000 dependable subscribers.

Whilst you’re focused on one issue and need to begin a YouTube channel on the subject, it is best to seek out out what’s concerned and the steps you might want to take instantly. My step-by-step data on How one can Make Cash On YouTube may also help you do that.

#15: Lease Out House In Your Dwelling

Whilst you’re comfy letting a stranger crash in your house, keep in mind renting a room in your house by the use of Airbnb.

Lease out your full dwelling, an additional mattress room, or that storage dwelling you frolicked altering your self.

Possibly you may have gotten a basement which is able to very properly be rented out do it’s important to added a kitchenette. Regardless of area you may have gotten, resolve on a price, then pointers it on Airbnb to see do it’s important to get any motion.

#16: Lease Your Parking House

If in case you will have a parking area that sits empty more often than not, you may lease it out by the use of SpotHero. It truly works largest in an infinite metropolis with restricted parking, like Chicago or New York. Nonetheless, it would presumably furthermore work do it’s important to hold close to a extreme airport or apply station.

The suitable half is you may lease out your area for restricted durations of time primarily based in your schedule. Whilst you’re going down a two-week journey and likewise you gained’t use your parking area that full time, as an illustration, you may open your rental calendar for these dates and money in if any particular person takes you up on the supply.

#17: Lease Out Your Automotive

Lastly, keep in mind renting out your automotive utilizing an online web page like Turo.com. It’s a ride-sharing platform that connects automotive house owners with individuals who’ve to lease a automotive.

How moderately loads are you able to earn? It is dependent upon the place you reside, the dates your automotive is offered available on the market, and the kind of automotive you’re renting out. Whilst you non-public a Tesla, you may earn higher than $130 each day. Whilst you non-public an expensive sports activities actions actions automotive, like a Porsche, moderately extra.

Jeeps are furthermore widespread on the positioning, with many house owners charging higher than $75 per day to lease their journey. Even should you presumably can solely lease your automotive a number of days per 30 days, it could be price it.

Making Cash Whereas You Sleep: The Backside Line

As you may see, there are an quite a few variety of methods to become worthwhile when you sleep. Some require an upfront funding of money, others help you to get began with creative considering or one good thought. The suitable half is you may implement varied of those income-producing methods instantly.

Regardless of you do, don’t sit on the sidelines to see if passive revenue begins trickling in by itself. Apart from you win the lottery, the probabilities of that occuring are slim to none.

[ad_2]